Instant Loan Apps That Actually Help You in 2025

Let me begin with a confession: I was extremely wary of instant loan apps. You know the ones: loud ads on social media, too-good-to-be-true offers, and horror stories about harassment. But everything changed when a personal emergency forced me to look for quick financial help. No time for paperwork, no room for delay. That's when I turned to instant loan apps. And to my surprise, a few of them didn’t just deliver; they exceeded my expectations.

In this post, I’ll share my personal experience using some of the most popular instant loan apps in India 2025. These aren’t affiliate recommendations or paid promotions. Just an honest account of what worked for me (and what didn’t).

Here’s my detailed take on:

- Navi

- KreditBee

- Slice

- PaySense

- TrueBalance

- MoneyView

- mPokket

What Are Instant Loan Apps?

Instant loan apps are mobile applications that allow users to borrow money quickly and with minimal paperwork. These platforms use digital verification processes to assess your creditworthiness and disburse loans, often within minutes. They are designed for short-term or emergency borrowing and usually don’t require collateral.

Most of these apps offer loans ranging from a few thousand rupees up to a few lakhs, with repayment tenures that can range from a few days to several months. What makes them popular is the speed, convenience, and accessibility they offer, especially to younger borrowers and those without traditional credit histories.

Are Instant Loan Apps Safe?

This is probably the most common question, and rightly so. The short answer is: some are safe, and some are not.

The key is to stick with apps that are:

- Registered with the Reserve Bank of India (RBI) or tied to an RBI-registered NBFC

- Transparent about fees, interest rates, and repayment terms

- Have good user reviews and no history of predatory collection practices

Apps like Navi, Paysense, and MoneyView are tied to recognized financial institutions and follow proper compliance guidelines. On the other hand, some lesser-known or unregistered apps may charge exorbitant interest and resort to harassment if you miss payments.

Pro tip: Always read the app permissions before downloading, and never share your personal information on an app that seems shady or unprofessional.

1. Navi

Navi was the first app I tried, and I still consider it one of the best out there.

What happened: I applied for a ₹21,000 personal loan late at night. Within 15 minutes, the money was credited to my account. I was shocked - in a good way.

Why it impressed me:

- Fast disbursal, literally within minutes

-

Get a loan amount up to ₹20,000,000

- Minimal documentation (just PAN and Aadhaar)

- Transparent terms, Zero foreclosure charges

- Interest rates were flat and predictable, which is up to 26%

- 100% paperless process, Zero foreclosure charges

Downsides: Navi works best for salaried individuals with decent credit scores. Self-employed folks might face hurdles.

My Opinion: Ideal for emergencies, especially if you want something quick and reliable.

2. KreditBee

This app helped me during my internship when cash flow was a real issue.

What happened: I borrowed ₹12,000 to cover rent and groceries while waiting for my stipend. KreditBee gave me the loan in under an hour.

What I liked:

- Low entry barrier (even students can apply)

- Loans start from ₹6,000 to ₹10 lakhs

- Short-term loans available

- User-friendly interface

Challenges:

- Interest rates are on the higher side, from 12% to 28.5% p.a. KreditBee EMI Calculator

- Miss a due date, and you'll get aggressive reminders

My Opinion: Great for short-term needs, especially for young professionals and students. Just don’t make it a habit.

3. Slice

Slice isn’t your typical loan app - it’s more like a modern banking app without the usual baggage.

What happened: I started using Slice for daily expenses using the UPI method.

What I loved:

- Instant credit line upon approval

- Zero annual or joining fees

- Cashback on selected purchases

- Flexible bill-splitting feature

Watch out for: You can easily overspend if you’re not tracking your expenses. Self-discipline is key.

My Opinion: Perfect for an emergency fund.

4. PaySense

Paysense was a savior when I wanted to buy a laptop for work and couldn’t afford the full price upfront.

What happened: I applied for a loan of ₹1,15,000. The approval took a day, but the EMI options were well-structured.

Pros:

- Pre-approved offers for repeat users

- Instant Personal Loans up to ₹5 lakh

- No collateral required

Cons:

- Slightly longer processing time than Navi

- Requires more documentation upfront

My Opinion: Great for bigger purchases or medium-term needs. It's more traditional but trustworthy.

5. TrueBalance

I found this app while looking for a small emergency loan during a weekend trip gone wrong (read: stolen wallet).

What happened: Needed ₹5,000 urgently. TrueBalance approved and transferred the money in 10 minutes.

Why it stood out:

- Instant disbursal for amounts as low as ₹1,000

- Helps manage mobile recharges, bills, and insurance, too

Downsides:

- The interface is a bit clunky

- Higher interest rates on microloans

My Opinion: Best for very short-term emergencies. Think of it as your financial SOS button.

6. MoneyView

MoneyView is for those who like structure. It gives you a good mix of flexibility and discipline.

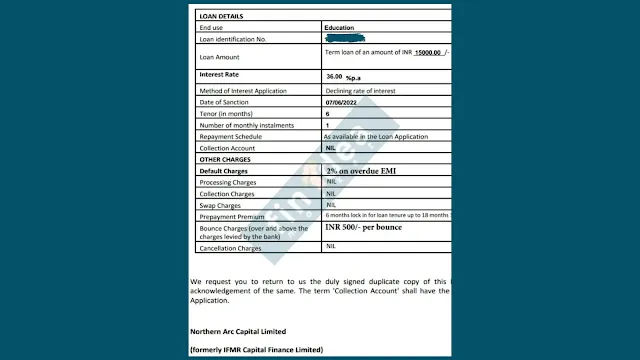

My experience: Took a ₹15,000 loan with a 6-month repayment tenure. The app gave me a detailed repayment schedule and even reminded me a day in advance.

Pros:

- Decent interest rates

- Credit score tracking is built in

- Loans from ₹5,000 to ₹5 lakh

Cons:

- Strict eligibility criteria

- The initial KYC process is thorough, maybe too much for some

My Opinion: Best if you're planning to borrow more and repay responsibly. It helps build your credit profile.

7. mPokket

If you’re a college student or just starting your first job, mPokket is probably already on your radar.

What happened: I used mPokket during my final year of college. ₹3,000 here, ₹5,000 there - it helped me bridge the gap between my monthly budget and actual expenses.

Perks:

- Direct bank or wallet transfer

- Good for small-ticket loans

- Documentation is super basic

What to watch out for: Very high interest on small loans. Repay on time to avoid getting into a loop.

My Opinion: Excellent entry-level loan app, but don’t abuse it. It’s easy to over-borrow.

Final Thoughts

Instant loan apps have changed the way we think about short-term borrowing in India. In 2025, they are faster, smarter, and more regulated than ever. But like any financial tool, they come with responsibility.

Here’s what I’ve learned:

- Always read the fine print

- Don’t borrow more than you can repay

- Use these apps as a bridge, not a crutch

- A good credit score still matters

If you’re careful and informed, these apps can genuinely help you out of a bind. For me, they made the difference between stress and survival.

Would I use them again? Yes - but only when absolutely necessary. And always with a plan to pay it back fast.

Have a question about any of these apps or want to share your experience? Drop it in the comments!

Disclaimer

We are not responsible for anything from this application, so please take your own risk before applying for a loan. Fin Idea Market